Your source to global events that impact the economic recovery and other musings for the not so faint-hearted.

Sunday, July 10, 2011

ECB Caught in Inflation Trap

By Grant de Graf

The ECB recently increased its key interest rate by a quarter of a percent to 1.5%, in response to rising inflation which measured 2.7% for June, above the central bank's target rate of 2%. ECB President Jean Claude has indicated that he will not hesitate to hike interest rates further, to constrain inflationary pressures.

Despite higher "inflation" levels, growth rates in Europe remain constrained, unemployment is high at 9.3% and economic sentiment has plunged.

Historically, inflation has occurred in times of rapid growth and the mechanism that policymakers have used to fight the one-eyed tiger, is through monetary policy, namely interest rates. The intent of central banks in dealing with inflation through interest rates, is to curtail monetary supply, which occurs through credit expansion.

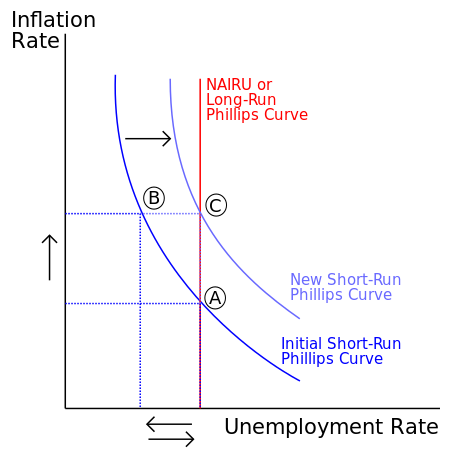

There are two main weaknesses in this approach. Firstly, there is always a question of governments being able to define and calculate inflation accurately. For example, higher inflation in the EU this year, is more likely to be a function of rising commodity prices than credit or monetary expansion. This can be substantiated by the fact that inflation is normally accompanied by a decrease in unemployment as clarified by the Phillips curve, and this has not occurred. Consequently, the EU is trying to manage an inflation problem that does not exist.

Secondly, using interest rates to control inflation runs counter to free-market theory, as setting the interest rate is subjective and randomly determined by policymakers. If the central bank gets it wrong, then they are effectively distorting the demand and supply curve for money, which could impact an economy, negatively.

Government-induced inflation (simplistically viewed as a function of printing too much money) normally occurs in periods of high growth, affording policymakers the ability to use interest rates to constrain credit expansion and slow economic activity. Europe is not experiencing a phase of high growth and therefore, increasing interest rates beyond the point of equilibrium (where the supply of money effectively meets demand), distorts the free-market adjustment mechanism within the economy that could automatically rectify an imbalance. Instead, the higher interest rates hamper efforts to facilitate growth and could plunge the EZ back into a recession.

The ECB now finds itself in a position where "inflation" is increasing, high rates of unemployment are on a rise and GDP levels are declining. Due to the negative impact that it may have on growth and levels of unemployment, using interest rates as an instrument to manage "inflationary" pressures, is no longer an option.

The ECB recently increased its key interest rate by a quarter of a percent to 1.5%, in response to rising inflation which measured 2.7% for June, above the central bank's target rate of 2%. ECB President Jean Claude has indicated that he will not hesitate to hike interest rates further, to constrain inflationary pressures.

Despite higher "inflation" levels, growth rates in Europe remain constrained, unemployment is high at 9.3% and economic sentiment has plunged.

Historically, inflation has occurred in times of rapid growth and the mechanism that policymakers have used to fight the one-eyed tiger, is through monetary policy, namely interest rates. The intent of central banks in dealing with inflation through interest rates, is to curtail monetary supply, which occurs through credit expansion.

There are two main weaknesses in this approach. Firstly, there is always a question of governments being able to define and calculate inflation accurately. For example, higher inflation in the EU this year, is more likely to be a function of rising commodity prices than credit or monetary expansion. This can be substantiated by the fact that inflation is normally accompanied by a decrease in unemployment as clarified by the Phillips curve, and this has not occurred. Consequently, the EU is trying to manage an inflation problem that does not exist.

Secondly, using interest rates to control inflation runs counter to free-market theory, as setting the interest rate is subjective and randomly determined by policymakers. If the central bank gets it wrong, then they are effectively distorting the demand and supply curve for money, which could impact an economy, negatively.

Government-induced inflation (simplistically viewed as a function of printing too much money) normally occurs in periods of high growth, affording policymakers the ability to use interest rates to constrain credit expansion and slow economic activity. Europe is not experiencing a phase of high growth and therefore, increasing interest rates beyond the point of equilibrium (where the supply of money effectively meets demand), distorts the free-market adjustment mechanism within the economy that could automatically rectify an imbalance. Instead, the higher interest rates hamper efforts to facilitate growth and could plunge the EZ back into a recession.

The ECB now finds itself in a position where "inflation" is increasing, high rates of unemployment are on a rise and GDP levels are declining. Due to the negative impact that it may have on growth and levels of unemployment, using interest rates as an instrument to manage "inflationary" pressures, is no longer an option.

Subscribe to:

Posts (Atom)